Terms and Conditions

- Definitions

TrueMoney Philippines – refers to True Money Philippines, Inc., a domestic stock corporation incorporated in the Philippines. It is authorized and regulated by Bangko Sentral ng Pilipinas (BSP) as an issuer of electronic money in the Philippines.

TrueMoney Member – an individual who uses the TrueMoney service and whose name appears on the online form or signed enrollment or application form, as may be applicable. Refers also to the Principal Account Holder.

TrueMoney Account – an account that stores Philippine Peso (PhP) value in the TrueMoney Philippines system which may be linked to the Account Holder’s mobile phone number.

TrueMoney Center – any accredited establishment authorized by TrueMoney Philippines to perform TrueMoney services.

Biller – any accredited company authorized to accept bills payment using the TrueMoney service.

Short Message Service (SMS) – a communications protocol allowing the interchange of short text messages between mobile telephone devices.

One Time Pin (OTP) – A one-time password (OTP) is an automatically generated numeric or alphanumeric string of characters that authenticates the user for a single transaction or login session.

KYC – Know Your Customer, this is the process of obtaining information to identify and verify the identity of the person. This is a mandate by BSP.

The TrueMoney Account refers to a reloadable electronic wallet that can be redeemed at indicated value. It is not a depository account, thus is not covered by the Philippine Deposit Insurance Corporation (PDIC) and does not earn interest. Neither shall it not earn monetary rewards and other similar incentives convertible to cash, nor special discount privileges. However, as a financial transaction, it is subject to the rules and regulations of the Bangko Sentral ng Pilipinas (BSP) and the Anti-Money Laundering Act (AMLA), under Republic Act No. 9160. TrueMoney Philippines holds responsibility in ensuring that each TrueMoney Member would receive at face value the redeemed amount in Philippine Peso (PhP) at the main office of TrueMoney Philippines. Furthermore, the monetary value is guaranteed regardless if the account has expired, terminated or cancelled or should the company decide to cease operations. Fraudulent transaction or any investigation in relation to a fraudulent case shall forfeit this applicability. In any event of unauthorized use of the service, TrueMoney Philippines shall not be liable for any inconvenience and damage caused to the TrueMoney Member, or a third party. Neither is the company liable for any failure by the TrueMoney Member to avail of the service for whichever reason might be indicated.TrueMoney Philippines may suspend or terminate use of the service for whatever legal reasons it deems proper. In the event of any suspension, termination or confiscation of the service, the TrueMoney Member agrees to hold TrueMoney Philippines free and harmless from any claim, damages, loss, expenses, suit or liability whatsoever, arising from such suspension, termination or confiscation.

2. Withdrawal – The amount indicated in the TrueMoney account may be withdrawn from any TrueMoney Center. Minimum and maximum withdrawal amounts may be imposed by TrueMoney Philippines.

3. Transaction and Account Limits – Pursuant to applicable laws, TrueMoney Philippines may assign or change transaction and/or account balance limits, subject to sixty (60) days prior notice in the form of an SMS/Text message to TrueMoney Members. The limits assigned by TrueMoney Philippines shall be based on the TrueMoney account, product type, and the completeness of the information provided by the TrueMoney Member to TrueMoney Philippines.

4. Upon acceptance of the Terms and Conditions, the TrueMoney Member shall agree to abide by the KYC requirements set forth by TrueMoney Philippines (e.g., Full Name, Date of Birth, Complete Address and other information) in line with BSP’s requirement. TrueMoney Philippines may also ask for valid ID/s or other documentation to verify the accuracy of the KYC Information provided. The information provided by the True Money Member shall be verified through third party vendors, as deemed necessary, and as required by the regulator.

5. In line with the submitted KYC Information, the TrueMoney Member agrees to provide consent to TrueMoney Philippines to share the information with third party vendors, remittance partners and third party databases, as necessary, for the purpose of fulfilling Anti-Money Laundering (AML) requirements and compliance thereof.

6. TrueMoney reserves the right to verify any activity that is done through the application services, especially if it involves compliance with AML requirements or requirements of other laws, rules, or regulations.

7. SMS – Short Message ServicesTrueMoney Members shall be automatically signed up for “SMS” (Short Message Service), including text alerts:

A TrueMoney Member agrees and authorizes TrueMoney Philippines to send promotional advertisements of its products and services through mail, short messaging service, multimedia messaging services, electronic mail and other forms of telecommunication, unless it has notified TrueMoney Philippines otherwise.

A TrueMoney Member shall abide and be bound by the instructions and/or procedures of TrueMoney Philippines during the use of SMS. The TrueMoney Member shall have no claim, recourse or remedy against TrueMoney Philippines for any loss, damage and expense incurred arising from non-compliance with such instructions and/or procedures.

A TrueMoney Member shall not hold TrueMoney Philippines responsible or liable for any loss or damage which he/she may incur or suffer, directly or indirectly arising out of or in connection with SMS, due to any reason whatsoever including but not limited to breakdown or malfunction of the computer, its terminal connection lines, data processing system or transmission line, whether or not belonging to TrueMoney Philippines or any circumstances beyond TrueMoney Philippines’ control.

TrueMoney Philippines is entitled to effect any changes to SMS, suspend and/or terminate SMS and to vary SMS at any time upon its sole and absolute discretion without assigning any reason and without prejudice to any of its rights of action for any antecedent breach of these terms and conditions by a TrueMoney Member.

A TrueMoney Member hereby irrevocably agrees to hold free and harmless TrueMoney Philippines, and indemnify TrueMoney Philippines against all actions, claims, demands, liabilities, losses, damages, costs and expenses of whatever nature as a result of agreeing to this section. TrueMoney Philippines shall in no way be liable to a TrueMoney Member for any action the latter takes in reliance on SMS Alerts purporting to be from TrueMoney Philippines, but does not proceed from TrueMoney Philippines’ official SMS Alert number.

8. Activation and Deactivation of TrueMoney Service Features – TrueMoney Philippines may introduce additional service features, and may also deactivate existing features at any time. TrueMoney Philippines may, on a case-to-case basis, suspend or terminate a TrueMoney Member’s privilege to use a particular feature, whenever it deems appropriate, and without prior notice. It covers, but is not limited to, occasions of fraudulent transactions or suspicious activities. However, TrueMoney Philippines may reactivate the said feature and charge a reactivation fee, upon request of the TrueMoney Member. Approval of the request shall be the sole option of TrueMoney Philippines.

9. Loyalty/Rewards Program – On the use of the service, TrueMoney Philippines may formulate a Loyalty/Rewards Program. Individual member’s rights and obligations to the said Loyalty/Rewards Program shall be covered by separate and specific terms and conditions.

10. Fees, Rates and Other Charges – The TrueMoney Member shall pay card replacement fees and dormancy fees in such amounts as may be imposed by TrueMoney Philippines to entitle the TrueMoney Member to the use of the TrueMoney service and the privileges that come with it. All fees are non-refundable.The TrueMoney Member agrees to pay other fees and charges and applicable taxes related to the TrueMoney service and its use, as may be imposed by TrueMoney Philippines, such as, but not limited to load and encashment fees. Fees and other charges, as may be applicable, shall be inclusive of all applicable Philippine taxes and shall be debited from the TrueMoney account or paid upfront. Should these fees and other charges result in a debit balance in the TrueMoney account, the amount shall be due and demandable from the TrueMoney Member and/or debited from the TrueMoney account upon the availability or replenishment of funds thereof without prior notice. The amount of fees and charges may be revised from time to time as TrueMoney Philippines may deem necessary.

11. Disputes – Transactions are authorized when any one of the following conditions is met: (a) the TrueMoney Member’s fingerprint has been scanned as identity validation, (b) the TrueMoney Member’s PIN/password is successfully keyed-in, or (c) the TrueMoney Member made a request through the service hotline by dialing (02) 88768440 or by emailing [email protected]. This shall be efficient evidence that any and all activity has been made and validated, and cannot be disputed by the TrueMoney Member.The details in the receipt page after transaction confirmation SMS/Text confirmation message after transactions are presumed true and correct unless the TrueMoney Member notifies TrueMoney Philippines in writing of any disputes thereon within fifteen (15) days from the date of transaction. If no dispute is reported within the said period, all transactions are deemed true and correct. Disputed transactions shall only be credited back to the TrueMoney Member’s account once the claim/dispute has been properly processed, investigated and proven to be in favor of the TrueMoney Member.

12. There shall be no reversals for erroneous transactions made by the TrueMoney Member. Once TrueMoney Member confirms the transaction occurred and/or successful, TrueMoney Member cannot cancel nor reverse such transaction. TrueMoney shall proceed with crediting the account of the recipient and once the money or fund is in the account of the beneficiary or recipient, TrueMoney cannot reverse nor deduct such account without the proper court order.

13. Unclaimed Remittance – In the event there is any remittance that remains unclaimed after a period of 30 days from the remittance date, such shall be subject to a handling fee of Php 30 or 1% of the principal amount, per month, whichever is higher. If such remains unclaimed, the Sender authorizes TrueMoney to dispose the money in whatever way or means it deems proper, including but not limited to donation or consignment.

14. Complaints – Any complaints about TrueMoney Philippines or its services should be directed to the service hotline by dialing (02) 7718-9999 or by emailing [email protected]. It must clearly state that the TrueMoney Member is filing a complaint, to distinguish the complaint from an inquiry along with pertinent details that can be used to resolve the complaint such as TrueMoney Member ID number, transaction date and amount and a brief narrative of the complaint. All complaints and feedback will be reviewed and addressed accordingly. Furthermore, this will be used to improve TrueMoney’s business and customer service.

15. TrueMoney Service Security – A TrueMoney Member shall be responsible for the security of his/her TrueMoney account, the mobile phone’s Subscriber Identity Module (SIM) and his/her Personal Identification Number (PIN) or password. All transactions made using the service are conclusively presumed made by the TrueMoney Member and the TrueMoney Member shall be responsible thereof. The TrueMoney Member has the option to change his/her PIN/password from time to time or when he suspects the possibility of unauthorized present or future use of the account.

16. Loss and Theft of the TrueMoney Card Security and proper care of the TrueMoney account, as well as the confidentiality of his/her PIN and password, shall be the TrueMoney Member’s sole responsibility.

Loss – In case of loss, TrueMoney Member shall immediately inform TrueMoney Philippines within twenty-four (24) hours through the service hotline of such loss, via telephone or through a written report submitted to the company. Cancellation of the TrueMoney Card shall be processed, only upon proper authentication of the phone call or the signature in the written report, as the case may be. All purchases and transactions made through the use of the service prior to the report of loss or theft shall continue to be the liability of the TrueMoney Member. A replacement TrueMoney Card may also be created at the cost of the TrueMoney Member In addition, the lost TrueMoney Card will be cancelled and deactivated. The TrueMoney Member shall have no claim, recourse or remedy against TrueMoney Philippines for any loss, damage and expense incurred arising from non-compliance with such instructions and/or procedures.

Found – If the company discovers that the TrueMoney Member used both new and old access cards for any fraudulent transactions, the issue shall be dealt with in accordance to Article 15.

Theft – In case of theft, TrueMoney Member shall immediately inform TrueMoney Philippines within one (1) hour through the service hotline of such loss, via telephone or through a written report submitted to the company. Cancellation of the TrueMoney Card shall be processed, only upon proper authentication of the phone call or the signature in the written report, as the case may be. All purchases and transactions made through the use of the service prior to the report of loss or theft shall continue to be the liability of the TrueMoney Member. A replacement TrueMoney Card may also be created at the cost of the TrueMoney Member. The TrueMoney Member shall have no claim, recourse or remedy against TrueMoney Philippines for any loss, damage and expense incurred arising from non-compliance with such instructions and/or procedures.

17. Fraudulent Transactions

Blocked Account – In the event that TrueMoney Philippines detects or uncovers fraudulent and/or suspicious transactions or use by an unauthorized person, the company shall have the right to automatically suspend or block the TrueMoney account. The company is not obligated to inform the TrueMoney Member regarding this action. Furthermore, the TrueMoney Member acknowledges the authority of TrueMoney Philippines to suspend or block the TrueMoney account, and shall not hold the company accountable against any undue consequences due to suspension or block, nor any loss or damage thereof. Also, TrueMoney Philippines reserves the right to report any suspicious activities to the relevant law enforcement agencies.

Discretion – TrueMoney Philippines reserves absolute discretion (a) to refuse to approve any proposed TrueMoney transaction even if there is sufficient available balance, (b) to suspend, terminate, or cancel the TrueMoney Member’s right to use the account, (c) to increase or decrease the balance limit, (d) to refuse to reissue, renew or replace the TrueMoney account and/or (e) to introduce, amend, vary, restrict, terminate or withdraw the benefits, services, facilities and privileges with respect to or in connection with the TrueMoney account, whether specifically relating to the TrueMoney Member, or generally to all or specific TrueMoney Members, but subject to Article 26 below. This shall apply, but is not limited, in the event:

- of any fault or failure in the data information processing system;

- that the company reasonably believes these accounts have been used, or are likely to be used or the TrueMoney Member allowed them to be used, in breach of this Agreement or to commit an offence;

- that any Remaining Balance may be at risk of fraud or misuse;

- that the company suspects a TrueMoney Member provided false or misleading information;

- that the company suspects that the account may be used to make fraudulent or suspicious transactions or be used by an unauthorized person; and

- of an order or recommendation of the Philippine National Police, other law-enforcement agencies, or any relevant governmental or regulatory authority.

18. Expiry, Renewal, Reinstatement, Dormancy, and Cancellation of Account

Expiry – The TrueMoney Member shall not use the TrueMoney account after the expiry date indicated thereon. Renewal of the TrueMoney account shall be subject to the approval of TrueMoney Philippines. A TrueMoney account which has been suspended by TrueMoney Philippines may be reinstated by the latter at its option. The TrueMoney Member’s continued use upon suspension, termination or expiration shall be considered a fraudulent act and will be grounds for criminal action. TrueMoney Philippines reserves the right to charge a dormancy fee or not to renew, temporarily or permanently, the service upon expiration, cancellation or suspension, if the TrueMoney account remains inactive and/or not loaded over a fixed period of time as may be required by TrueMoney Philippines.

Cancellation – The TrueMoney Member may elect to cancel his/her account even before the set expiry date. The TrueMoney Member concerned must call or provide a written notice of cancellation to TrueMoney Philippines. Customer Services shall immediately suspend all further use of his/her account, within one (1) working day upon notice. Once the accounts have been cancelled.

Remaining Value – Any peso value remaining in the TrueMoney account after cancellation and/or expiration shall be processed by TrueMoney Philippines according to the rules set forth by the Bangko Sentral ng Pilipinas (BSP).

19. Termination of TrueMoney Service – Should (a) the TrueMoney Member fail to comply with the Terms and Conditions provided herein or for any reason fail to renew the TrueMoney account or the TrueMoney account is not renewed by TrueMoney Philippines, (b) the account has been used on suspicious and/or fraudulent activity, (c) if the account was imposed with a freeze order by the governing regulatory authority/ies, or (d) the TrueMoney Member dies or becomes insolvent, however evidenced, the right to use the TrueMoney account shall be terminated without prior notice and any aggregate and unpaid charges, fees and other expenses for which the TrueMoney Member is liable shall immediately become due without need of demand and may be immediately debited without prior notice from any remaining funds, money and assets of the aforementioned TrueMoney Member.

20. Change of Telephone Numbers/Address – The TrueMoney Member shall immediately notify TrueMoney Philippines via telephone or written notice of any changes in his/her residence, office or mailing address and/or telephone numbers.

21. Change of Name – The TrueMoney Member, within seven (7) days of a court decision or registered marriage, shall immediately notify TrueMoney Philippines by sending a written notice of any changes in the name of the TrueMoney Member. The TrueMoney Member shall likewise attach certified true copies of the necessary documents, such as but not limited to marriage certificate or court order, as proof or evidence of such change.

22. Exclusion from Liability – TrueMoney Philippines makes no warranty, express or implied, regarding the performance or functionalities of the service offered hereunder. The service is offered on an “AS IS”, “AS AVAILABLE” basis without warranties of any kind, other than warranties that are incapable of exclusion, waiver or limitation under the laws applicable to this terms. Without limiting the generality of the foregoing, TrueMoney Philippines makes no warranty (1) as to the content, quality or accuracy of data or information provided by TrueMoney Philippines hereunder or received or transmitted using the TrueMoney service functionalities, (2) as to any service or product obtained using the service functionalities, (3) that the service will be uninterrupted or error-free or (4) that any particular result or information will be obtained. TrueMoney Philippines shall not be liable for any loss, costs, compensation, damage or liability to the TrueMoney Member or third party arising directly or indirectly as a result of any or all of the following:

The service is honored by any bank, financial institution, ATM or merchant; however, payment transaction is not authorized for any reason whatsoever.

TrueMoney Member is unable to perform or complete any transaction thru the use of any device due to service/system/line unavailability.

Any delay, interruption or termination of the service transaction whether caused by administrative error, technical, mechanical, electrical or electronic fault or difficulty or any other reason or circumstance beyond TrueMoney Philippines’ control (including but not limited to acts of God, strike, labor disputes, fire disturbance, action of government, atmospheric conditions, lightning, interference or damage by third parties or any change in legislation).

Theft or unauthorized use of the TrueMoney account or any loss, costs, damages or payables to any third party by the TrueMoney Member.

Any misrepresentation or fraud by or misconduct of any third party, such as but not limited to owners or employees of TrueMoney Centers.

Other analogous transactions that may affect, harm, and/or damage the reputation, processes, or integrity of the TrueMoney services, TrueMoney Philippines, and the TrueMoney Member, if not specified or indicated in this Terms and Conditions.

23. Limitation of Liability – In the event of any action that the TrueMoney Member may file against TrueMoney Philippines, the TrueMoney Member agrees that TrueMoney Philippines’ liability shall not exceed One Thousand Pesos (P1,000.00) or the amount of damages actually suffered by the TrueMoney Member, whichever is lower.

24. Indemnity Clause – The TrueMoney Member shall reimburse TrueMoney Philippines for all actions, proceedings and claims which may be brought by or against the TrueMoney Philippines, and all losses, damages and reasonable amounts of costs and expenses which TrueMoney Philippines may incur or suffer as a result of or in connection with its providing services to TrueMoney Member under this Agreement, unless due to TrueMoney Philippines’ gross negligence or willful default and only to the extent of direct and reasonably foreseeable loss and damage (if any) arising directly and solely from it. Member shall provide reasonable assistance, at the member’s expense, in defending any such claim. True Money reserves the right to approve counsel retained by Member, to take control of the defense (at TrueMoney’s expense) of any claim for which indemnity is required, and to participate in the defense of any claim (at TrueMoney’s expense) for which indemnity is required. If a claim is brought against Member, this may not be settled without TrueMoney’s prior consent.

25. Consent to Processing of Information – The TrueMoney Member authorizes and gives consent to the TrueMoney Philippines, its associates, affiliates, subsidiaries, officers, employees, lawyers and other related persons as the company deems necessary for the following:

Collect and verify any information about the TrueMoney Member from any third party;

collect, process, store, record, organize, update, modify, block, erase and destroy (collectively referred to as “process”) the TrueMoney Member’s personal and account information with the company and any information the company obtains from third parties, including account information with other financial or non-financial institutions;

transfer, disclose and use the TrueMoney Member’s personal and account information (including information that the company obtains from third parties, such as other financial or non-financial institutions), to, between and among its Authorized Third Parties, other financial or non-financial institutions or the outsourced service providers of such entities, wherever situated, or a Government Requirement, for any lawful purpose such as business development, data processing, analysis and management, surveys, product and service offers, marketing activities, risk management purposes, and compliance with laws.

The above consent applies for the duration of and even after the closure or cancellation of the account/s. The consent will be effective despite any applicable non disclosure agreement.

The TrueMoney Member acknowledges that information relating to him/her and his/her accounts, including Confidential Information, may be transferred to jurisdictions which do not have strict data protection or data privacy laws.

The TrueMoney Member declares that he has provided any notices, consents and waivers necessary to permit the company, its Authorized Third Parties to carry out the actions described in this provision.

The TrueMoney Member also agrees to hold TrueMoney Philippines free and harmless from any liability that may arise from the processing and use of the personal and account information, and other information pertaining to the account.

To process payment services, members will be required to provide personally identifiable information when making a transaction. This may include but not limited to:

a. Full name

b. Physical and/or mailing address;

c. Financial information, including but not limited to credit or debit card numbers or bank account information;

d. Email address; and,

e. Phone number

Also, TrueMoney may automatically collect information from devices and browsers including but not limited to:

a. Device information, such as a unique device identifier; and,

b. Location information, such as IP address or geo-location.

26. Data Sharing – We take care to allow your personal information to be accessed only by those who require access to perform their tasks and duties, and to share only with third parties who have a legitimate purpose for accessing it. TrueMoney will never sell or rent your personal information to third parties without your explicit consent. When there is a need for us to share your personal data to our third party affiliates and partners, we will ensure that personal data will be protected under the terms of Data Sharing Agreement and Contractual obligations.

We may disclose and share your personal data to the following:

- Any member of the TrueMoney Group, its directors, officers, employees, duly authorized representatives, related companies and affiliates;

- Third party service providers and vendors including credit card processors, data analytics, marketing services, customer support providers, and IT service providers who are bound by an obligation of confidentiality. They will have access to your personal data only as necessary to perform their requested function on your behalf, and if they have adequate security and privacy standards acceptable to TrueMoney;

- Any authority, regulator, supervisory, enforcement agency, exchange, court, quasi-judicial body or tribunal;

- Professional advisers including accounting, tax, financial or legal counsel; or

- Anyone we consider necessary for purposes of providing you products and services and other purposes mentioned above.

- Publicity – Members grant TrueMoney permission to use member’s name and logo in TMN’s marketing materials including, but not limited to use on TMN’s website, social media posts, in customer listings, in interviews and in press releases.

Cross Border Transfers – To facilitate our international operations, TrueMoney may transfer, store, and process your information within our family of companies, partners, and service providers based throughout Asia, including Singapore, Thailand and possibly other countries. We contractually obligate recipients of your personal information to agree to at least the same level of privacy safeguards as required under applicable data protection laws. By communicating electronically with TrueMoney, you acknowledge and agree to your personal information being processed in this way.

27. Venue of Litigation – Venue of all suits shall either be at Pasig City or at any location at the exclusive option of TrueMoney Philippines.

28. Non-Waiver of Rights – Failure, omission, or delay on the part of TrueMoney Philippines to exercise its right or remedies under these Terms and Conditions shall not operate as a waiver. Any such waiver shall be valid only when reduced in writing and delivered to the TrueMoney Member.

29. Separability Clause – Should any term or condition in this Agreement be rendered void, illegal or unenforceable in any respect under any law, the validity, legality, and enforceability of the remaining terms and conditions shall not be affected or impaired thereby.

30. Amendments – TrueMoney Philippines may at any time and for whatever reason it may deem proper amend, revise or modify these Terms and Conditions without further notice. TrueMoney Philippines shall notify TrueMoney Members of pertinent changes to these Terms and Conditions via SMS or email. The TrueMoney Member’s continued use of the TrueMoney service after any such change constitutes acceptance of the new Terms and Conditions. Failure to notify TrueMoney Philippines of the TrueMoney Member’s intention to terminate his/her account shall be construed as acceptance by the TrueMoney Member of the amendment to these Terms and Conditions.

31. Agreement – The TrueMoney Member agrees to be bound by the Terms and Conditions governing the issuance and use of the TrueMoney service. A TrueMoney Member’s signature on activation or use of the TrueMoney wallet shall also be deemed as acceptance of and agreement to be bound by these Terms and Conditions and such amendments hereof as may be made by TrueMoney Philippines from time to time. These Terms and Conditions shall bind the members and their heirs, executors and administrators, successors and assignees, for legal accountability and documentary purposes. These Terms and Conditions shall be governed by and construed in accordance with the laws of the Republic of the Philippines.

Privacy Policy Statement

Updated: October 2022

True Money Philippines Inc., including its affiliates and subsidiaries (the “Company”), values your privacy. Our privacy policy values and protects your personal information under the Data Privacy Act of 2012 and the laws of the Philippines. This privacy policy describes our personal information handling practices when you access our services, which include our content on the websites located at truemoney.com.ph, TrueMoney portals or when you use the TrueMoney mobile app and related services (referred to collectively hereinafter as “Services”).

ACCEPTANCE OF THIS PRIVACY POLICY

By accessing and using our Services, you signify acceptance to the terms of this Privacy Policy. Where we require your consent to process your personal information, we will ask for your consent to the collection, use, and disclosure of your personal information as described further below. We may provide additional “data consent” about the data collection and processing practices of specific Services. These notices may supplement or clarify our privacy practices or may provide you with additional choices about how we process your data.

If you do not agree with or you are not comfortable with any aspect of this Privacy Policy, you should immediately discontinue access or use of our Services.

LINKS TO WEBSITES OUTSIDE OF TrueMoney

To provide website visitors with more information that may be helpful to them, some of our websites contain links to other websites that are not affiliated with or maintained by TrueMoney. We do not monitor the privacy practices of these third-party sites, and do not have authority over them. As a result, you fully understand and acknowledge that we do not assume any responsibility for the data collection policies and procedures of these sites.

SPECIAL NOTICE – if you are a minor under the applicable law

Our website and services are not aimed at children who are regarded minors per the applicable law, and we will not collect, use, provide or process in any other form any personal information of children under such age and in any case of any age younger than 18 years old, deliberately. We therefore also ask you, if you are still considered a minor and younger than the age of 18 , to please do not send us your personal information (for example, your name, address and email address). We will not bear any responsibility for such information provided to us.

If you are under the status of a minor per your applicable law and younger than the age of 16 and you nevertheless wish to ask a question or use this website in any way which requires you to submit your personal information, please get your parent or guardian to do so on your behalf while specifying such clearly.

CHANGES TO THIS PRIVACY POLICY

True Money reserves the right to modify this Privacy Statement. Updated privacy statements will be posted on this Website when amendments occur. We urge you to review this Privacy Statement when you visit to obtain the most current statement.

I. THE PERSONAL INFORMATION WE COLLECT

Personal Information (PI) is typically data that identifies an individual or relates to an identifiable individual. This includes information you provide to us, information which is collected about you automatically, and information we obtain from third parties such as name, date and place of birth, specimen signature, photo, present and permanent address, source of fund or income, name of employer or the nature or self-employment or business, contact details such as personal telephone number, personal mobile number and personal email address, mother’s maiden name, cookie information, contacts list, geolocation, and information about the device you use to interact with us.

We may also collect Sensitive Personal information (SPI) such as an individual’s race, age, marital status, government issued numbers peculiar to an individual which includes (e.g. SSS, GSIS, UMID, Drivers License, etc.)

II. HOW WE COLLECT PERSONAL INFORMATION

We collect your Personal Information when you:

- register and get verified to True Money through paper forms, web application forms, and mobile application

- use our True Money service through our partner agents and different channels

- provide us with supporting documents to validate your identity;

- disclose your personal information through customer support, emails, SMS or verbal communication with our authorized representatives, some calls maybe recorded for quality and monitoring purposes

- visit and contact us through our official websites and social media channels; and

- through your interest in TrueMoney advertisements placed on third party sites

III. PURPOSE OF PERSONAL INFORMATION COLLECTION

Our primary purpose in collecting personal information is to provide you with secure, smooth, efficient transaction needs and avail our services. We generally use personal information to create, develop, operate, deliver, and improve our Services, content and advertising.

Additionally we collect personal information for the purpose of the following:

- Identifying, investigating and preventing financial crimes, including fraud, bribery, money laundering and terrorist financing, including but not limited to the submission of reports to the Anti-Money Laundering Commission (AMLC);

- Enforcing and/or defending the rights of TrueMoney before any agency, court, tribunal, quasi-judicial body;

- Recognizing other lawful or legitimate commercial or business purposes necessary for the performance of, or in relation to, a contract or service to which the data subject is a party;

- When necessary or desirable in the context of an employer-employee relationship between TrueMoney and the data subject; and

- Enabling TrueMoney to exercise governance over its businesses and ensuring that risks arising therefrom are duly identified, measured, managed and mitigated.

We may also collect personal data from other sources (e.g., your employers, credit bureaus, associations/organizations, etc.) as lawfully permitted.

For Partnerships and Corporate entities, you represent and warrant that you have (a) advised your data subjects of the purpose/s of collecting personal data and disclosure thereof to TrueMoney, their rights as data subjects and other relevant information, and (b) obtained the necessary consent and authority to disclose personal data of your directors, officers, employees, members and other representatives to TrueMoney, pursuant to the Data Privacy Act, its Implementing Rules and Regulations and other applicable laws and regulations.

IV. WITH WHOM WE MAY DISCLOSE AND SHARE YOUR PERSONAL DATA

We take care to allow your personal information to be accessed only by those who require access to perform their tasks and duties, and to share only with third parties who have a legitimate purpose for accessing it. TrueMoney will never sell or rent your personal information to third parties without your explicit consent. When there is a need for us to share your personal data to our third party affiliates and partners, we will ensure that personal data will be protected under the terms of Data Sharing Agreement and Contractual obligations.

We may disclose and share your personal data to the following:

Any member of the TrueMoney Group, its directors, officers, employees, duly authorized representatives, related companies and affiliates;

Third party service providers and vendors including credit card processors, data analytics, marketing services, customer support providers, and IT service providers who are bound by an obligation of confidentiality. They will have access to your personal data only as necessary to perform their requested function on your behalf, and if they have adequate security and privacy standards acceptable to TrueMoney;

Any authority, regulator, supervisory, enforcement agency, exchange, court, quasi-judicial body or tribunal;

Professional advisers including accounting, tax, financial or legal counsel; or

Anyone we consider necessary for purposes of providing you products and services and other purposes mentioned above.

V. PROTECTING YOUR PERSONAL DATA

The processing of your personal data exposes you to financial, legal, regulatory or reputational risks that may result from the unauthorized processing or disclosure of personal data. TrueMoney is committed to protecting the privacy of all personal data provided to us. We maintain physical, technical and organizational safeguards to protect your personal data against loss, theft, unauthorized access, disclosure, copying, use or modification.

We use computer safeguards such as firewalls and data encryption, we enforce physical access controls to our buildings and files.

We limit access to those who have a business need to know. We are responsible for all personal data in our possession, including information transferred to third parties performing services on our behalf. All such persons, wherever they are located, are required by us to protect the confidentiality and privacy of your personal data in a manner consistent with our privacy policies and practices.

VI. RETENTION PERIOD

We store your personal information, registration and transaction records for 5 years after closure of your account in adherence with the requirement of the BSP and other laws and regulations. These data will be destroyed in adherence with our physical and/or technical information security measures when retention is no longer required with respect to existing laws, rules or regulation.

VII. CROSS BORDER TRANSFERS

To facilitate our international operations, TrueMoney may transfer, store, and process your information within our family of companies, partners, and service providers based throughout Asia, including Singapore, Thailand and possibly other countries. We contractually obligate recipients of your personal information to agree to at least the same level of privacy safeguards as required under applicable data protection laws. By communicating electronically with TrueMoney, you acknowledge and agree to your personal information being processed in this way.

VIII. YOUR RIGHTS AS DATA SUBJECTS

As Data Subjects, you have the following rights:

- Right to be informed. You have the right to be informed whether your personal data is being, or has been processed, including the existence of automated decision-making and profiling, including any personal data breach which is likely to result in a risk for your rights and freedoms.

- Right to object. You have the right to object to the processing of your personal data, including processing for application, direct marketing, automated processing or profiling. You may also opt NOT to receive marketing information from TrueMoney. Opting and objecting out means that TrueMoney will not proceed processing your personal data.

- Right to Access. You have the right to reasonable access, upon written request, to the contents of your personal data that were processed. You also have the reasonable right to know the manner by which these were processed; the sources from which these were obtained; the recipients and reasons for disclosure, if any; date when your information was last modified; and information on automated processes where your information will be used as the sole basis for any decision that may significantly affect you.

- Right to rectify erroneous data. You have the right to correct any error in the personal data and if warranted, request immediate rectification.

- Right to Erase or Block (right to be forgotten). You have, based on reasonable grounds and the public interest in the availability of the data, the right to suspend, withdraw or order the blocking, removal or destruction of your personal data from TrueMoney’s filing system, without prejudice to TrueMoney continuing to process personal data for commercial, operational, legal and regulatory purposes.

- Right to secure Data Portability. Where personal data is processed by electronic means and in a structured and commonly used format, you have the right to obtain from TrueMoney a copy of such data in an electronic or structured format that is commonly used and allows your further use.

- Right to be indemnified for damages. You shall be indemnified for any damages sustained due to such inaccurate, incomplete, outdated, false, unlawfully obtained or unauthorized use of personal data, taking into account any violation of your rights and freedoms as a data subject.

- Right to File a Complaint. You may file a complaint or exercise your rights above by reaching out to us through the contact details provided below. You may also raise privacy concerns to the applicable authority in your jurisdiction.

If you have questions about TrueMoney’s Privacy Statement and Policy, our data processing activities or your dealings with this web site, you can contact the Data Privacy Officer by telephone at (632) 8718 9999 or via e-mail [email protected]. You may also email us at [email protected], or call telephone no. TrueMoney Customer Service (+632 8718 9999) or your account manager, as may be applicable. Our business hours are from 8:00 AM to 7:00 PM, Mondays to Fridays.

Read more about the FAQs on DATA PRIVACY ACT OF 2012

Updated February 2022

Terms and Conditions

- Definitions

TrueMoney Philippines – refers to True Money Philippines, Inc., a domestic stock corporation incorporated in the Philippines. It is authorized and regulated by Bangko Sentral ng Pilipinas (BSP) as an issuer of electronic money in the Philippines.

TrueMoney Member – an individual who uses the TrueMoney services and whose name appears on the online form or signed enrollment or application form, as may be applicable. Refers also to the Principal Account Holder.

TrueMoney Account – an account that stores Philippine Peso (PhP) value in the TrueMoney Philippines system which may be linked to the Account Holder’s mobile phone number.

TrueMoney Center – any accredited establishment authorized by TrueMoney Philippines to perform TrueMoney services.

Biller – any accredited company authorized to accept bills payment using the TrueMoney service.

Short Message Service (SMS) – a communications protocol allowing the interchange of short text messages between mobile telephone devices.

Airtime – refers to the time measured by mobile phone operators (or carriers) when they measure usage. It is typically measured in minutes for voice calls but also covers text and data usage.

One Time Pin (OTP) – A one-time password (OTP) is an automatically generated numeric or alphanumeric string of characters that authenticates the user for a single transaction or login session.

KYC – Know Your Customer, this is the process of obtaining information to identify and verify the identity of the person. This is a mandate by BSP.

The TrueMoney Account refers to a reloadable electronic wallet that can be redeemed at indicated value. It is not a depository account, thus is not covered by the Philippine Deposit Insurance Corporation (PDIC) and does not earn interest. Neither shall it not earn monetary rewards and other similar incentives convertible to cash, nor special discount privileges. However, as a financial transaction, it is subject to the rules and regulations of the Bangko Sentral ng Pilipinas (BSP) and the Anti-Money Laundering Act (AMLA), under Republic Act No. 9160. TrueMoney Philippines holds responsibility in ensuring that each TrueMoney Member would receive at face value the redeemed amount in Philippine Peso (PhP) at the main office of TrueMoney Philippines. Furthermore, the monetary value is guaranteed regardless if the account has expired, terminated or canceled or should the company decide to cease operations. Fraudulent transaction or any investigation in relation to a fraudulent case shall forfeit this applicability. In any event of unauthorized use of the service, TrueMoney Philippines shall not be liable for any inconvenience and damage caused to the TrueMoney Member, or a third party. Neither is the company liable for any failure by the TrueMoney Member to avail of the service for whichever reason might be indicated.TrueMoney Philippines may suspend or terminate use of the service for whatever legal reasons it deems proper. In the event of any suspension, termination or confiscation of the service, the TrueMoney Member agrees to hold TrueMoney Philippines free and harmless from any claim, damages, loss, expenses, suit or liability whatsoever, arising from such suspension, termination, withdrawal or confiscation.

2. Withdrawal

The amount indicated in the TrueMoney account may be withdrawn from any TrueMoney Center. Minimum and maximum withdrawal amounts may be imposed by TrueMoney Philippines. TrueMoney Member agrees to pay other fees and charges during withdrawal transaction, as may be imposed by TrueMoney Philippines. All fees and other charges, as may be applicable, shall be inclusive of all applicable Philippine taxes and shall be debited from the TrueMoney Account or paid upfront.

3. Transaction and Account Limits

Pursuant to applicable laws, TrueMoney Philippines may assign or change transaction and/or account balance limits, subject to fifteen (15) days prior notice in the form of an SMS/Text message to TrueMoney Members. The limits assigned by TrueMoney Philippines shall be based on the TrueMoney Account, product type, and the completeness of the information provided by the TrueMoney Member to TrueMoney Philippines.

4. Acceptance of the Terms & Conditions

TrueMoney Member shall agree to abide by the KYC requirements set forth by TrueMoney Philippines (e.g., Full Name, Date of Birth, Complete Address and other information) in line with BSP’s requirement. TrueMoney Philippines may also ask for valid ID/s or other documentation to verify the accuracy of the KYC Information provided. The information provided by the TrueMoney Member shall be verified through third party vendors, as deemed necessary, and as required by the regulator.

5. Submitted KYC Information

TrueMoney Member agrees to provide consent to TrueMoney Philippines to share the information with third party vendors, remittance partners and third party databases, as necessary, for the purpose of fulfilling Anti-Money Laundering (AML) requirements and compliance thereof.

6. TrueMoney reserves the right to verify any activity that is done through the application services, especially if it involves compliance with AML requirements or requirements of other laws, rules, or regulations.

7. SMS – Short Message Services

TrueMoney Members shall be automatically signed up for “SMS” (Short Message Service), including text alerts:

A. TrueMoney Members agrees and authorizes TrueMoney Philippines to send promotional advertisements of its products and services through mail, short messaging service, multimedia messaging services, electronic mail and other forms of telecommunication, unless it has notified TrueMoney Philippines otherwise.

B. TrueMoney Members shall abide and be bound by the instructions and/or procedures of TrueMoney Philippines during the use of SMS. The TrueMoney Member shall have no claim, recourse or remedy against TrueMoney Philippines for any loss, damage and expense incurred arising from non-compliance with such instructions and/or procedures.

C. TrueMoney Members shall not hold TrueMoney Philippines responsible or liable for any loss or damage which he/she may incur or suffer, directly or indirectly arising out of or in connection with SMS, due to any reason whatsoever including but not limited to breakdown or malfunction of the computer, its terminal connection lines, data processing system or transmission line, whether or not belonging to TrueMoney Philippines or any circumstances beyond TrueMoney Philippines’ control.

D. TrueMoney Philippines is entitled to effect any changes to SMS, suspend and/or terminate SMS and to vary SMS at any time upon its sole and absolute discretion without assigning any reason and without prejudice to any of its rights of action for any antecedent breach of these terms and conditions by a TrueMoney Member.

E. TrueMoney Members hereby irrevocably agrees to hold free and harmless TrueMoney Philippines, and indemnify TrueMoney Philippines against all actions, claims, demands, liabilities, losses, damages, costs and expenses of whatever nature as a result of agreeing to this section. TrueMoney Philippines shall in no way be liable to a TrueMoney Member for any action the latter takes in reliance on SMS Alerts purporting to be from TrueMoney Philippines, but does not proceed from TrueMoney Philippines’ official SMS Alert number.

8. Activation and Deactivation of TrueMoney Service Features

TrueMoney Philippines may introduce additional service features, and may also deactivate existing features at any time. TrueMoney Philippines may, on a case-to-case basis, suspend or terminate a TrueMoney Member’s privilege to use a particular feature, whenever it deems appropriate, and without prior notice. It covers, but is not limited to, occasions of fraudulent transactions or suspicious activities. However, TrueMoney Philippines may reactivate the said feature and charge a reactivation fee, upon request of the TrueMoney Member. Approval of the request shall be the sole option of TrueMoney Philippines.

9. Cash-in Service

Cash-in shall refer to the ability of an account holder to fund or add money in his/her TrueMoney Account through accredited Channels, where Channels refer to entities which can transfer electronic money to a TrueMoney Account. TrueMoney Philippines shall accept all the information entered by the account holder as true and correct once a transaction is accepted by the Channel and TrueMoney Philippines or vice versa and shall be conclusive against the account holder.

10. Bills Payment

Payment of bills to accredited billers listed in TrueMoney Mobile Application using funds from TrueMoney Account shall be available. TrueMoney Philippines reserves the right to make available or deactivate the bills payment feature in its Mobile Application and to add and remove the billers available therein, as deemed necessary.

Payment of bills does not require a printed receipt from the Biller. The act of paying a biller to a biller’s TrueMoney Account and/or other authorization shall be conclusive proof of authorization for a payment, for the amount paid, to the account indicated, or for unlocking internet transactions, through TrueMoney Mobile Application. Once the transaction has been authorized and consummated, TrueMoney Philippines shall not be held liable for any undelivered goods and non-performance of services, defects, damages, and after-sales services of such goods and/or services, any error in the amount keyed-in or entered, and/or any other dispute between the biller and the TrueMoney Member arising from such payment. TrueMoney Philippines shall exert reasonable efforts to address and/or assist the Customer on concerns or disputes on involved Transactions, within TrueMoney Philippines’ capabilities, terms of use, and applicable policies, laws and regulations, and may impose fees when applicable.

A confirmation screen is displayed on the Mobile Application for every transaction. TrueMoney Member shall validate and check the data to ensure correct information prior to processing of the payment. Once the customer confirms all the details are correct via the “Confirmation Button” on the Mobile Application, TrueMoney Philippines shall not be liable for any error in the amount keyed-in or entered, and/or any other dispute between the biller and the TrueMoney Member arising from such payment.

The TrueMoney reference number in the Mobile Application transaction logs shall constitute the TrueMoney Member’s proof of payment.

All bills payment transactions shall be in accordance with the terms of use as stated herein.

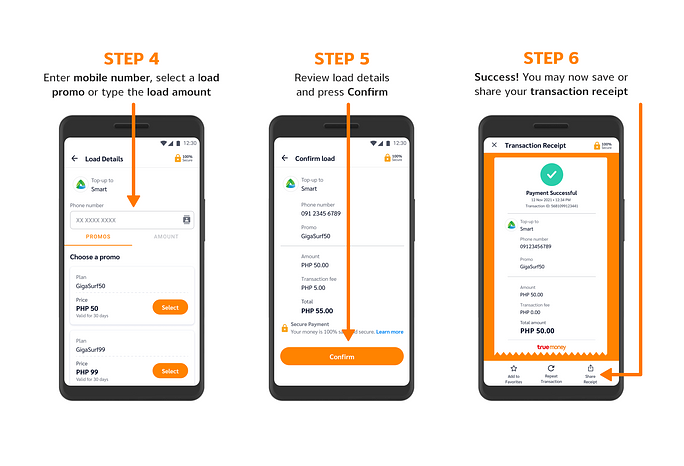

11. AIRTIME LOAD

Loading of airtime credits and using funds from a TrueMoney Account shall be available via keyword-based commands or menu-based transactions.

A confirmation screen is displayed on the mobile application for every transaction. TrueMoney Member validates and checks the data to ensure correct information prior to purchase of the airtime load.

The TrueMoney reference number in the Mobile Application transaction log shall be the TrueMoney Member’s proof of payment.

12. Send Money

TrueMoney Member may transfer value from his/her TrueMoney Account to another TrueMoney Account and/or other accredited partners using the TrueMoney Mobile Application, provided that he/she has undergone and passed KYC. Once authenticated and logged-in to the TrueMoney Mobile Application, and once the transfer is consummated therein, the transfer of any value and/or any activity is deemed valid and cannot be disputed by the TrueMoney Member..

A confirmation screen is displayed on the Mobile Application for every transaction. TrueMoney Member validates and checks the data to ensure correct information prior to transaction processing.

The transfer of value is subject to send money amount limits set by TrueMoney Philippines within reasonable cause and within applicable laws and regulations. Transfers are subject to security features such as, but not limited to, limitation in number of successful transactions, limits in amount to be transferred and may depend on various factors including platform, channel and product.

13. Loyalty/Rewards Program

TrueMoney Philippines may formulate a Loyalty/Rewards Program. Individual member’s rights and obligations to the said Loyalty/Rewards Program shall be covered by separate and specific terms and conditions.

14. Fees, Rates and Other Charges

TrueMoney Member agrees to pay other fees and charges and applicable taxes related to the TrueMoney Account services and its use, as may be imposed by TrueMoney Philippines, such as, but not limited to load and encashment fees. Fees and other charges, as may be applicable, shall be inclusive of all applicable Philippine taxes and shall be debited from the TrueMoney Account or paid upfront. Should these fees and other charges result in a debit balance in the TrueMoney account, the amount shall be due and demandable from the TrueMoney Member and/or debited from the TrueMoney Account upon the availability or replenishment of funds thereof without prior notice. The amount of fees and charges may be revised from time to time as TrueMoney Philippines may deem necessary.

15. Disputes

Transactions are authorized when any one of the following conditions is met:

A. The TrueMoney Member’s fingerprint has been scanned as identity validation

B. The TrueMoney Member’s PIN/password is successfully keyed-in, or

C. The TrueMoney Member made a request through the service hotline by dialing (02) 7718-9999 or by emailing [email protected]. This shall be efficient evidence that any and all activity has been made and validated, and cannot be disputed by the TrueMoney Member. The details in the receipt page after transaction confirmation SMS/Text confirmation message after transactions are presumed true and correct unless the TrueMoney Member notifies TrueMoney Philippines in writing of any disputes thereon within Thirty (30) days from the date of transaction. If no dispute is reported within the said period, all transactions are deemed true and correct. Disputed transactions shall only be credited back to the TrueMoney Member’s account once the claim/dispute has been properly processed, investigated and proven to be in favor of the TrueMoney Member.

16. Erroneous Transactions

There shall be no reversals for erroneous transactions made by the TrueMoney Member. Once TrueMoney Member confirms the transaction occurred and/or successful, TrueMoney Member cannot cancel nor reverse such transaction. TrueMoney Philippines shall proceed with crediting the account of the recipient and once the money or fund is in the account of the beneficiary or recipient, TrueMoney Philippines cannot reverse nor deduct such account without the proper court order.

17. Complaints

Any complaints about TrueMoney Philippines or its services should be directed to the service hotline by dialing (02) 7718-9999 or by emailing [email protected]. It must clearly state that the TrueMoney Member is filing a complaint, to distinguish the complaint from an inquiry along with pertinent details that can be used to resolve the complaint such as TrueMoney Member ID number, transaction date and amount and a brief narrative of the complaint. All complaints and feedback will be reviewed and addressed accordingly. Furthermore, this will be used to improve TrueMoney’s business and customer service.

18. TrueMoney Service Security

A TrueMoney Member shall be responsible for the security of his/her TrueMoney account, the mobile phone’s Subscriber Identity Module (SIM) and his/her Personal Identification Number (PIN) or password. All transactions made using the service are conclusively presumed made by the TrueMoney Member and the TrueMoney Member shall be responsible thereof. The TrueMoney Member has the option to change his/her PIN/password from time to time or when he suspects the possibility of unauthorized present or future use of the account.

19. Fraudulent Transactions

A. Blocked Account – In the event that TrueMoney Philippines detects or uncovers fraudulent and/or suspicious transactions or use by an unauthorized person, the company shall have the right to automatically suspend or block the TrueMoney Account. The company is not obligated to inform the TrueMoney Member regarding this action. Furthermore, the TrueMoney Member acknowledges the authority of TrueMoney Philippines to suspend or block the TrueMoney account, and shall not hold the company accountable against any undue consequences due to suspension or block, nor any loss or damage thereof. Also, TrueMoney Philippines reserves the right to report any suspicious activities to the relevant law enforcement agencies.

B. Discretion – TrueMoney Philippines reserves absolute discretion (a) to refuse to approve any proposed TrueMoney transaction even if there is sufficient available balance, (b) to suspend, terminate, or cancel the TrueMoney Member’s right to use the account, (c) to increase or decrease the balance limit, (d) to refuse to reissue, renew or replace the TrueMoney Account and/or (e) to introduce, amend, vary, restrict, terminate or withdraw the benefits, services, facilities and privileges with respect to or in connection with the TrueMoney Account, whether specifically relating to the TrueMoney Member, or generally to all or specific TrueMoney Members, but subject to items below. This shall apply, but is not limited, in the event:

i. of any fault or failure in the data information processing system;

ii. that the company reasonably believes these accounts have been used, or are likely to be used or the TrueMoney Member allowed them to be used, in breach of this Agreement or to commit an offense;

iii. that any Remaining Balance may be at risk of fraud or misuse;

iv. that the company suspects a TrueMoney Member provided false or misleading information;

v. that the company suspects that the account may be used to make fraudulent or suspicious transactions or be used by an unauthorized person; and

vi. of an order or recommendation of the Philippine National Police, other law-enforcement agencies, or any relevant governmental or regulatory authority.

20. Expiry, Renewal, Reinstatement, Dormancy, and Cancellation of Account

A. Termination of TrueMoney Service – Should (a) the TrueMoney Member fail to comply with the Terms and Conditions provided herein or for any reason fail to renew the TrueMoney Account or the TrueMoney Account is not renewed by TrueMoney Philippines, (b) the account has been used on suspicious and/or fraudulent activity, (c) if the account was imposed with a freeze order by the governing regulatory authority/ies, or (d) the TrueMoney Member dies or becomes insolvent, however evidenced, the right to use the TrueMoney account shall be terminated without prior notice and any aggregate and unpaid charges, fees and other expenses for which the TrueMoney Member is liable shall immediately become due without need of demand and may be immediately debited without prior notice from any remaining funds, money and assets of the aforementioned TrueMoney Member.

B. Expiry – A TrueMoney Account which has been suspended by TrueMoney Philippines may be reinstated by the latter at its option. The TrueMoney Member’s continued use upon suspension, termination or expiration shall be considered a fraudulent act and will be grounds for criminal action. TrueMoney Philippines reserves the right to charge a dormancy fee or not to renew, temporarily or permanently, the service upon expiration, cancellation or suspension, if the TrueMoney Account remains inactive and/or not loaded over a fixed period of time as may be required by TrueMoney Philippines.

C. Dormancy policy – TrueMoney Philippines may charge dormancy maintenance fees on TrueMoney Mobile Application that have not been used for any monetary TrueMoney transaction for at least One (1) Year from the last date of transaction. The maintenance fee shall be automatically debited from the TrueMoney Member’s Wallet. TrueMoney Philippines, as may be applicable, can automatically close the account with zero balance that remains inactive for Two (2) years and with zero balances.

D. Cancellation – The TrueMoney Member may elect to cancel his/her account even before the set expiry date. The TrueMoney Member concerned must call or provide a written notice of cancellation to TrueMoney Philippines. Customer Services shall immediately suspend all further use of his/her account, within Five (5) working days upon notice. Once the accounts have been cancelled.

E. Remaining Value – Any peso value remaining in the TrueMoney account after cancellation and/or expiration shall be processed by TrueMoney Philippines according to the rules set forth by the Bangko Sentral ng Pilipinas (BSP).

21. Change of Personal Information

TrueMoney Member shall immediately notify TrueMoney Hotline via telephone or a written notice of any change in his/her residence, office or mailing address and/or telephone number/s, which shall be subject to verification by TrueMoney Philippines through presentation of proper documents such as, but not limited to true copies of certification from the NSO, marriage certificate, or court order, as proof or evidence of such change. The request shall be considered valid and final upon authentication of the user, based on TrueMoney’s verification process. Verification process may be through a Hotline security verification process.

As applicable, TrueMoney Member may also change their personal information via the Mobile Application, following the instructions and security measures set by TrueMoney Philippines. The request shall be considered valid and final upon authentication of user, based on TrueMoney’s verification process.

22. Exclusion from Liability

TrueMoney Philippines makes no warranty, express or implied, regarding the performance or functionalities of the service offered hereunder. The service is offered on an “AS IS”, “AS AVAILABLE” basis without warranties of any kind, other than warranties that are incapable of exclusion, waiver or limitation under the laws applicable to this terms. Without limiting the generality of the foregoing, TrueMoney Philippines makes no warranty (a) as to the content, quality or accuracy of data or information provided by TrueMoney Philippines hereunder or received or transmitted using the TrueMoney service functionalities, (b) as to any service or product obtained using the service functionalities, (c) that the service will be uninterrupted or error-free or (4) that any particular result or information will be obtained. TrueMoney Philippines shall not be liable for any loss, costs, compensation, damage or liability to the TrueMoney Member or third party arising directly or indirectly as a result of any or all of the following:

i. The service is honored by any bank, financial institution, ATM or merchant; however, payment transaction is not authorized for any reason whatsoever.

ii. TrueMoney Member is unable to perform or complete any transaction thru the use of any device due to service/system/line unavailability.

iii. Any delay, interruption or termination of the service transaction whether caused by administrative error, technical, mechanical, electrical or electronic fault or difficulty or any other reason or circumstance beyond TrueMoney Philippines’ control (including but not limited to acts of God, strike, labor disputes, fire disturbance, action of government, atmospheric conditions, lightning, interference or damage by third parties or any change in legislation).

iv. Theft or unauthorized use of the TrueMoney Account or any loss, costs, damages or payables to any third party by the TrueMoney Member.

v. Any misrepresentation or fraud by or misconduct of any third party, such as but not limited to owners or employees of TrueMoney Centers.

vi. Other analogous transactions that may affect, harm, and/or damage the reputation, processes, or integrity of the TrueMoney services, TrueMoney Philippines, and the TrueMoney Member, if not specified or indicated in this Terms and Conditions.

21. Limitation of Liability

In the event of any action that the TrueMoney Member may file against TrueMoney Philippines, the TrueMoney Member agrees that TrueMoney Philippines’ liability shall not exceed One Thousand Pesos (P1,000.00) or the amount of damages actually suffered by the TrueMoney Member, whichever is lower.

24. Indemnity Clause

The TrueMoney Member shall reimburse TrueMoney Philippines for all actions, proceedings and claims which may be brought by or against the TrueMoney Philippines, and all losses, damages and reasonable amounts of costs and expenses which TrueMoney Philippines may incur or suffer as a result of or in connection with its providing services to TrueMoney Member under this Agreement, unless due to TrueMoney Philippines’ gross negligence or willful default and only to the extent of direct and reasonably foreseeable loss and damage (if any) arising directly and solely from it. Member shall provide reasonable assistance, at the member’s expense, in defending any such claim. True Money reserves the right to approve counsel retained by Member, to take control of the defense (at TrueMoney’s expense) of any claim for which indemnity is required, and to participate in the defense of any claim (at TrueMoney’s expense) for which indemnity is required. If a claim is brought against Member, this may not be settled without TrueMoney’s prior consent.

25. Consent to Processing of Information

The TrueMoney Member authorizes and gives consent to the TrueMoney Philippines, its associates, affiliates, subsidiaries, officers, employees, lawyers and other related persons as the company deems necessary for the following:

A. Collect and verify any information about the TrueMoney Member from any third party;

B. Collect, process, store, record, organize, update, modify, block, erase and destroy (collectively referred to as “process”) the TrueMoney Member’s personal and account information with the company and any information the company obtains from third parties, including account information with other financial or non-financial institutions;

C. Transfer, disclose and use the TrueMoney Member’s personal and account information (including information that the company obtains from third parties, such as other financial or non-financial institutions), to, between and among its Authorized Third Parties, other financial or non-financial institutions or the outsourced service providers of such entities, wherever situated, or a Government Requirement, for any lawful purpose such as business development, data processing, analysis and management, surveys, product and service offers, marketing activities, risk management purposes, and compliance with laws.

The above consent applies for the duration of and even after the closure or cancellation of the account/s. The consent will be effective despite any applicable non disclosure agreement.

The TrueMoney Member acknowledges that information relating to him/her and his/her accounts, including Confidential Information, may be transferred to jurisdictions which do not have strict data protection or data privacy laws.

The TrueMoney Member declares that he has provided any notices, consents and waivers necessary to permit the company, its Authorized Third Parties to carry out the actions described in this provision.

The TrueMoney Member also agrees to hold TrueMoney Philippines free and harmless from any liability that may arise from the processing and use of the personal and account information, and other information pertaining to the account.

Also, TrueMoney may automatically collect information from devices and browsers including but not limited to:

- Device information, such as a unique device identifier; and,

- Location information, such as IP address or geo-location.

26. Data Sharing

We take care to allow your personal information to be accessed only by those who require access to perform their tasks and duties, and to share only with third parties who have a legitimate purpose for accessing it. TrueMoney will never sell or rent your personal information to third parties without your explicit consent. When there is a need for us to share your personal data to our third party affiliates and partners, we will ensure that personal data will be protected under the terms of Data Sharing Agreement and Contractual obligations.

We may disclose and share your personal data to the following:

- Any member of the TrueMoney Group, its directors, officers, employees, duly authorized representatives, related companies and affiliates;

- Third party service providers and vendors including credit card processors, data analytics, marketing services, customer support providers, and IT service providers who are bound by an obligation of confidentiality. They will have access to your personal data only as necessary to perform their requested function on your behalf, and if they have adequate security and privacy standards acceptable to TrueMoney;

- Any authority, regulator, supervisory, enforcement agency, exchange, court, quasi-judicial body or tribunal;

- Professional advisers including accounting, tax, financial or legal counsel; or

- Anyone we consider necessary for purposes of providing you products and services and other purposes mentioned above.

- Publicity – Members grant TrueMoney permission to use member’s name and logo in TMN’s marketing materials including, but not limited to use on TMN’s website, social media posts, in customer listings, in interviews and in press releases.

27. Cross Border Transfers

To facilitate our international operations, TrueMoney may transfer, store, and process your information within our family of companies, partners, and service providers based throughout Asia, including Singapore, Thailand and possibly other countries. We contractually obligate recipients of your personal information to agree to at least the same level of privacy safeguards as required under applicable data protection laws. By communicating electronically with TrueMoney, you acknowledge and agree to your personal information being processed in this way.

28. Venue of Litigation

Venue of all suits shall either be at Pasig City or at any location at the exclusive option of TrueMoney Philippines.

29. Non-Waiver of Rights

Failure, omission, or delay on the part of TrueMoney Philippines to exercise its right or remedies under these Terms and Conditions shall not operate as a waiver. Any such waiver shall be valid only when reduced in writing and delivered to the TrueMoney Member.

30. Separability Clause

Should any term or condition in this Agreement be rendered void, illegal or unenforceable in any respect under any law, the validity, legality, and enforceability of the remaining terms and conditions shall not be affected or impaired thereby.

31. Amendments

TrueMoney Philippines may at any time and for whatever reason it may deem proper amend, revise or modify these Terms and Conditions without further notice. TrueMoney Philippines shall notify TrueMoney Members of pertinent changes to these Terms and Conditions via SMS or email. The TrueMoney Member’s continued use of the TrueMoney service after any such change constitutes acceptance of the new Terms and Conditions. Failure to notify TrueMoney Philippines of the TrueMoney Member’s intention to terminate his/her account shall be construed as acceptance by the TrueMoney Member of the amendment to these Terms and Conditions.

32. Agreement

The TrueMoney Member agrees to be bound by the Terms and Conditions governing the issuance and use of the TrueMoney service. A TrueMoney Member’s signature on activation or use of the TrueMoney wallet shall also be deemed as acceptance of and agreement to be bound by these Terms and Conditions and such amendments hereof as may be made by TrueMoney Philippines from time to time. These Terms and Conditions shall bind the members and their heirs, executors and administrators, successors and assignees, for legal accountability and documentary purposes. These Terms and Conditions shall be governed by and construed in accordance with the laws of the Republic of the Philippines.

Yes. TrueMoney Wallet is secured. When you use TrueMoney Wallet, each account will have an individual 6-digit PIN. You can enable the Touch ID to implement a fingerprint validation system for added layers of security.

Do not share your PIN or OTP to anyone because once they learn of your PIN, they’ll have control over your TrueMoney Wallet account. Also, TrueMoney employees will never ask for your PIN. Most often these are scammers who impersonate TrueMoney employees.

No. Only one account per user is allowed to register with the TrueMoney Wallet app.

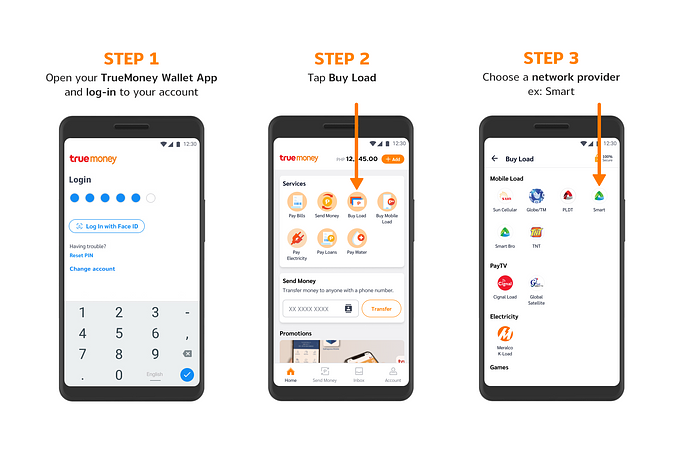

Through the Load feature, you can buy load for your mobile phone, whatever network it may be! Plus, you can also buy load for your other prepaid accounts, games, and more!

Make sure to submit any of the following valid IDs:

Driver’s License

UMID (Unified Multi-Purpose ID)

PASSPORT

TIN (Tax Identification Number)

Philhealth

Postal ID

Senior ID

Voter’s ID

SSS ID

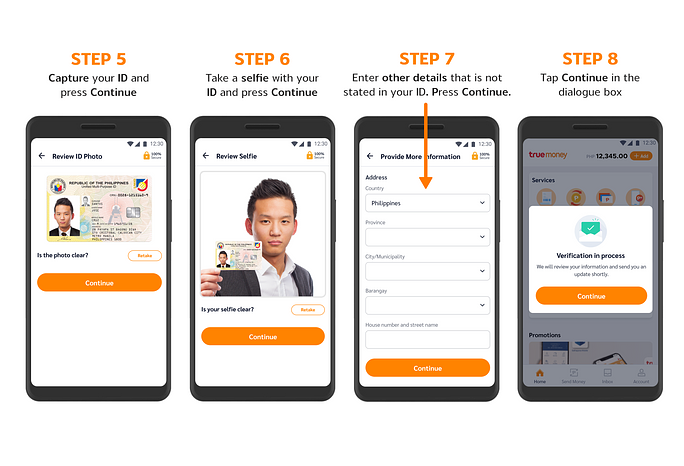

Here are some reminders before submitting your ID to TrueMoney:

- Make sure that your valid ID is:

- Clear and the ID information should be readable.

- The holographic stamp should not cover your ID information.

- Complete and not cropped.

- Taken in a well-lit place.

- Updated, valid and not expired.

- Not a photocopy and not captured from another device.

- Make sure that your SELFIE with your ID is:

- Clear and taken in a well lit place.

- Wearing appropriate/proper attire.

- Face should be fully captured on the frame.

- You should not be wearing a mask, eyeglass, headgear or other accessories.

- Should match the ID photo that you submitted.

- Make sure that the INFORMATION you submitted is the same with your ID:

- Your name and date of birth should match your ID information.

- The address that you have provided in the registration and ID should match.

- All the other information from your registration should match your ID.

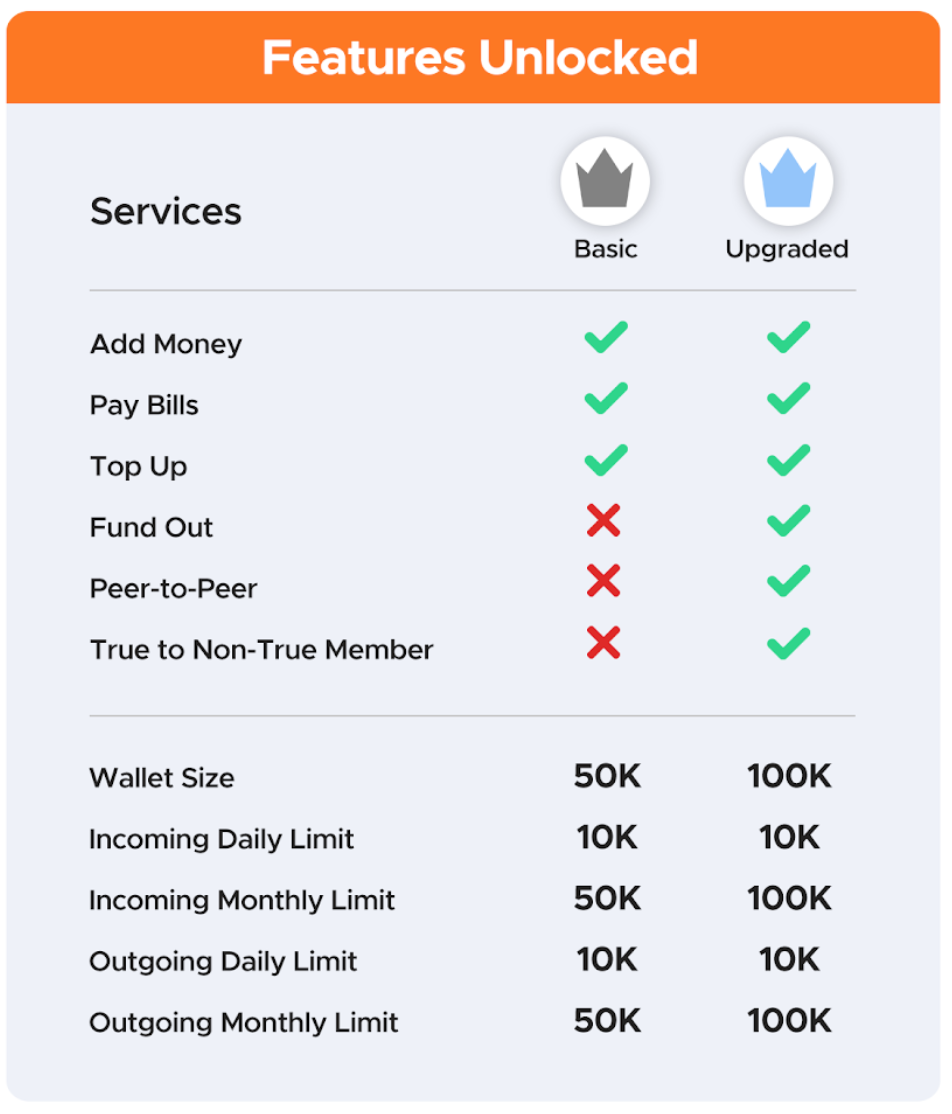

There is a transaction and balance limit for every TrueMoney Wallet account. Your Wallet limit will depend on your verification status (Basic or Upgraded) and will be the basis for how much you can transact per month.

Upgrade your TrueMoney Wallet for more features and enhanced security. You can send money to other TrueMoney Wallet accounts and even to non-TrueMoney Wallet users. Your monthly incoming and outgoing account limit will also be increased from P50,000 to P100,000.

To know more about the Basic and Upgraded TrueMoney Wallet accounts click the link here.

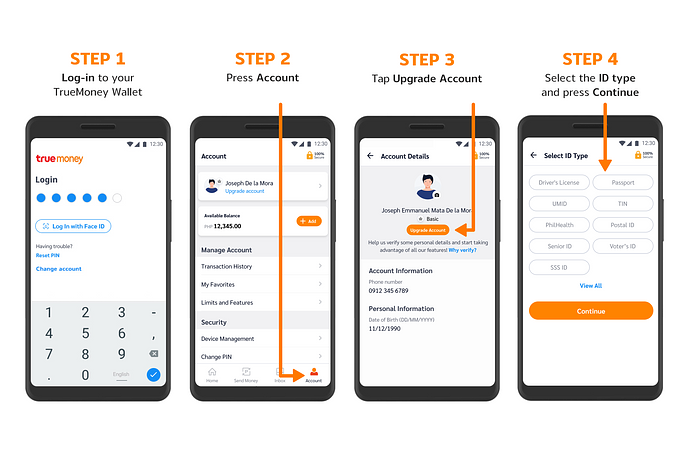

Follow these steps to upgrade:

1. Tap the TrueMoney Wallet app and log-in.